How To Build A Fintech App in 8 Simple Steps?

“Looking for the right moment to invest in fintech apps? This is your time to become tech-savvy when the market is ripe, benefits blooming, and chat or video API tools are readily available.”

The COVID-19 mania had made the whole world go haywire with deadly infections spreading from one end to technology seeing its advancements in every other sector. And one such area that eased the sleepless nights of many with tech is the financial domain.

Fintech is becoming one of the hottest topics in the industry with billion-dollar investments pouring in from all sides. Insights show that the fintech market is expected to grow over 19.8% CAGR of up to $332.5 Bn between the years 2022 to 2028.

Thus showcasing it to be an excellent time to set up your business with fintech web and mobile apps. Ready to step ahead with fintech app Development?

Before that,

Table of Contents

What is a Fintech App?

Fintech app refers to any web or mobile applications that make use of technology to help manage the finances of people. These apps grew into existence very lately after banks started to carry out all their services digitally.

Usually, a fintech app is said to have features like simplicity, push notifications, personalization, and high-level encryption.

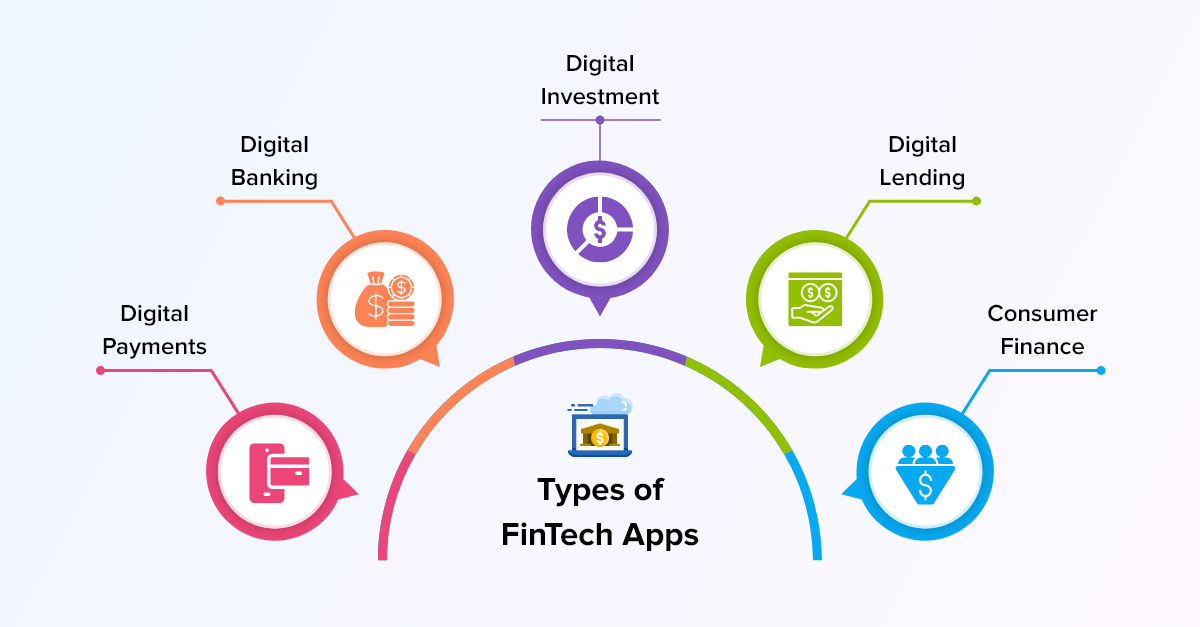

What are the Types of Fintech Apps?

Fintech examples are catered to various types like

- Digital Payments

- Digital Banking

- Digital Lending

- Digital Investment

- Consumer Finance

Next up on our list is,

How to Develop a Secure Fintech App in 8 Simple Steps?

Fintech application development is not an easy task because it requires a detailed analysis of the prime purpose of the construction of the app, which is financial. Therefore, it is crucial to ensure that the building process is carried out without any bells and whistles.

Below are the 8 Simple Steps To Building A Fintech App!

- Analyze the Type of Fintech App to Build

- Do a Market Research

- Plan a Budget Beforehand

- Build User Personas

- Focus a Lot on Visual Experience or User Interfaces

- Decide on the Features & App Requirements

- Choose the Right Tech Stack

- Develop Launch Strategy

1. Analyze the Type of Fintech App to Build

There are numerous fintech categories available on which apps can be developed because banking technology holds various applications for carrying out different tasks.

Note: The categories of financial apps are discussed above. In case you need to know what those are, scroll above to see them.

Therefore, any project we build will directly impact the user who uses the interface and leads who develops it. Below, let us quickly see a few of the categories and how difficult it is to turn them into digital.

- Personal Banking & Insurance: To develop these apps is difficult, expensive, complex, and time-consuming. Because, not only do they require an interactive user interface for admins to gain insights on user accounts, but users must also be able to make changes to their private accounts with ease.

- Loan Apps: Compared to the above-mentioned domain, these apps require less effort but high security because of the loan applications that need to be shared across the internet.

- Investment Apps: These apps require less manual effort and technology to build as they only display the investment information to users that guides them on what stocks to buy and lend. So, an API can be more sufficient for its development.

2. Do a Market Research

The days are not like they used to be during the 80s when individuals had to walk past the doors to get their passbooks printed. These days, even our grandparents know how to use a financial service using an iPad, such is the fintech growth.

But, just not sticking with this point, one must really do a survey as to whether such apps will survive in the market because a recent report says that 60% of individuals are least likely to operate digitally for their payments.

Hence, deep dive into the market research and analyze what the customer exactly needs and whether there are tech stacks for use case development. Plus, to make your fintech app stand out from the rest, you will need to audit your competitors’ work and pay a close eye to their features used and the benefits offered.

In turn, these rich analyses can help you build an innovative fintech app.

3. Plan a Budget Beforehand

Planning a budget for fintech mobile app development or web can come somewhere between $50,000 to $300,000. Considering that the range is very high, the complexity of the app and the features it includes also raise the budget bar. Therefore, it is necessary that you either recruit an experienced fintech app developer to design your product or hire a development agency.

Any newbie in the field or inexperienced and unskilled personnel can hamper your fintech app ideas leading to cutting corners of security, which many users would not recommend or like. Because a recent survey shows that over 65% of individuals prefer top-notch security in their fintech apps. We would suggest that you simply use a fintech and banking API for doing this work.

4. Build User Personas

While designing fintech apps, it is a mandate that we understand who our target audiences are and how they will react when a product is launched. And thus, user personas can be of great help in solving this difficulty for the business development team.

A user persona is none other than a fictional character who acts as a target audience and participates in interviews, surveys, and other research analyses to help teams visualize what the real audience would feel and think.

In turn, helping mobile and web developers to concentrate on the areas they missed and technical flows to improve. And, to build a user persona, the following steps can be taken into consideration:

- Conducting quality research

- Secondary quality research

- Organize all the findings

- Visualizing the personas and iterating if needed

5. Focus a Lot on Visual Experience or User Interfaces

Did you know that in the year 2021, over 60%+ users uninstalled the fintech apps just because their onboarding was not relevant? Hence then, it has become the main motive of many developers to map the user scenarios and design an interactive layout for eternal retention and engagement.

Well, how can you do this?

- Start by creating user personas as to which target audience wishes to experience what data on their screens.

- Do a market survey on the likings and dislikings of the app’s intro details.

- Iterate often the interface and look out for security errors if any.

- Always think in the shoes of users and then make decisions on analyses and techniques.

- Add investment goals and plans for gaining their interest.

6. Decide on the Features & App Requirements

Just like how the app’s interface plays a vital role in sticking customers to the app, what features to include within the application also needs to be prioritized. Some of the features to keep in mind would be

- Color of the Interface

- Look and feel of the app

- Icons and navigation panels

- Storage capacity and a few others

Similarly, requirements like the ones below can ensure potential customers use your fintech apps for a very long time.

- E2E encryptions and user authentication

- Payment integrations using any banking APIs

- AI learning and notifications

- Dashboards and reports

7. Choose the Right Tech Stack

If you are a developer who is looking for the best ways to develop a fintech app, then you must learn that an appropriate technology stack must be put into place that offers great functionality. Like,

- Framework: Whatever framework you use for both front-end and back-end programming, it must match with the programming language and your skill set.

- Programming Language: Javascript, Swift, and Kotlin are some of the popular programming languages used to develop fintech Android and iOS apps.

- Database: To store customers’ information and retrieve other data, relational databases can come in handy.

- Banking APIs: Also known as Fintech APIs can fasten your app development process by integrating real-time features that are required.

8. Develop Launch Strategy

A launch strategy does not include preparing for product launches or connecting with influencers alone, instead preparing a timeline that would include all the app checks with regulatory parameters. Meaning, whether all the attributes are in the correct place and whether the app complies with industry and legal requirements.

Imagine you are building a finance app, and for its successful operation and for users to exchange funds or make deposits, you would require a banking license. But, let me tell you that the licensing agencies are often slow and there is no guarantee, you will receive the license soon. Therefore, this parameter has to be on your checklist before ramping up for the launch.

Another example of a launch strategy is the soft launch for your finance app which will help drive the product to success by checking all the missing factors and making improvements if necessary. These types of launches give the opportunity to test bugs, collect user data, have a note of marketing spending, and take the app to the next level. Custom app designs are crucial for tailoring the user experience and ensuring the app meets specific business needs.

Finally, here we are at the end.

Final Closure!

As said before in the blog post, the fintech industry is said to grow, thus making it crucial to create fintech apps that would combat risks and offer great functionality to users.

And in case you are looking to add the utmost security features to your fintech apps, then

MirrorFly’s SaaS and self-hosted SDKs are always there at your support.

Our feature-rich in-app chat, voice, and video SDKs are highly compatible with platforms and deliver messages and calls with an average response time of 100ms and latency as low as 3s even during unstable network conditions.

Besides, if you would like to build your fintech apps with our 100% customizable video, voice, and chat features, check out our self-hosted solution today!

Get Started with MirrorFly’s Secure Chat Features Today!

Drive 1+ billions of conversations on your apps with highly secure 250+ real-time Communication Features.

Request Demo200+ Happy Clients

Topic-based Chat

Multi-tenancy Support

Frequently Asked Questions (FAQ)

Usually, building a simple FinTech app considering the project’s complexity, needs, and features, may take between 3 to 6 months. However, the timeline may extend to a year and more than 18 months if you are adding complex features to the app.

The cost of building a FinTech app depends on certain factors like the complexity of the app, number of users, scalability aspect, and experience of developers. Therefore, considering all these, the market price to build a FinTech app can cost you somewhere between $60,000 to $100,000. And if you are building a complex app with top-end features, then you may expect the price to reach o $150,000.

FinTech app development companies usually make use of different programming languages that depend on the needs and requirements of a project. However, the most common language that many firms use is Java because of its vast library of third-party components that helps to build complex FinTech apps. Above this, Java offers scalability, security, and great cross-platform compatibility.

The most common ways that a Fintech app can generate revenue is through in-app ads or referral fees. Third-party owners usually pay FinTech app owners whenever users click on the ads posted inside the app. And, the referral method works whenever a customer signs in to the app with a free value and then logs in for any new credit card offer, then the FinTech company gets a referral fee. Other revenue sources include in-app subscriptions, interest on deposits, and commission fees.

Further Reading

- How to Build A Flutter Video Call App in 2024?

- How to Build a React JS Video Chat App in 2024?

- How to Build an Android Voice and Video Calling App Using Java?

- Communication APIs: Top 7 In-app Chat, Voice & Video APIs

- Top 9 Secured Web Services to Build Your Own Video Calling App

This is one of the great article about secure fintech app development that i’m looking for. Thanks for sharing this useful article and keep up regularly updating about fintech app developer solutions.

Hello, we are looking for an API solution for fintech application development? We would like to integrate API with our ios and Android application. Do you have any demo fintech app project?

Hi we need to create a financial app for my online business. I need to integrate your api into my fintech app, I want to know the possibility of customization. Do you have voice developers offering for my project?

Hi, I want to app for fintech industry for my android app and I would like to watch a demo version on how we can integrate your api to our android and ios app. I want to discuss it. Let me know when your team is available.

Hi, Currently thinking to build a fintech app that will have the ability to make audio/video calls, can you provide me a list of prices and fintech app features? Please reply back to me with some more info. Thanks, Riyaz

Required to implement chat, group voice call, video call and screen sharing functionality in our fintech app . We are interested in licensing your product as part of our offering and would like to know more about your api.

I am currently building a fintech application for my business and i want to have the ability to group audio call with minimum eight participants and one-to-one options also. Is it easy to customize the behavior of my app. Do you have samples? how much does it cost to develop a fintech app? Kindly get back to me, as I need a solution fast.

Hi, We would like to build a secure fintech pp for a sales team of approximately 30 users. I would like to know the pricing and other features that surround your api. Can we arrange a call this week? Thanks

I would like to have a demo of fintech app development for android, ios and web. I would be glad to arrange that. I want to include an ability to make voice call using through app to app.

Hi, I am developing a fintech app for one of my client. I need a chat support. Can you give me more detail about pricing details how I can test before purchase. Is there any demo project? Thanks, Rahul